Reviewing 2023 and moving forward through the first quarter of 2024 for the Bellingham & Whatcom County housing market, everything falls back on interest rates.

Reviewing 2023.

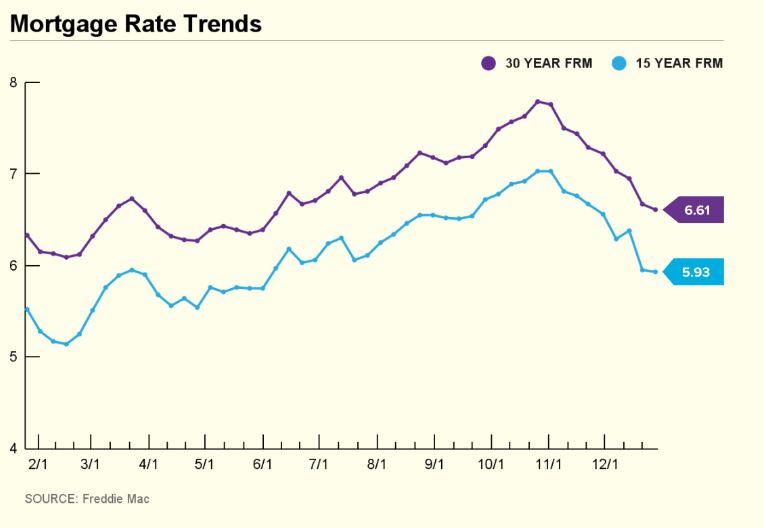

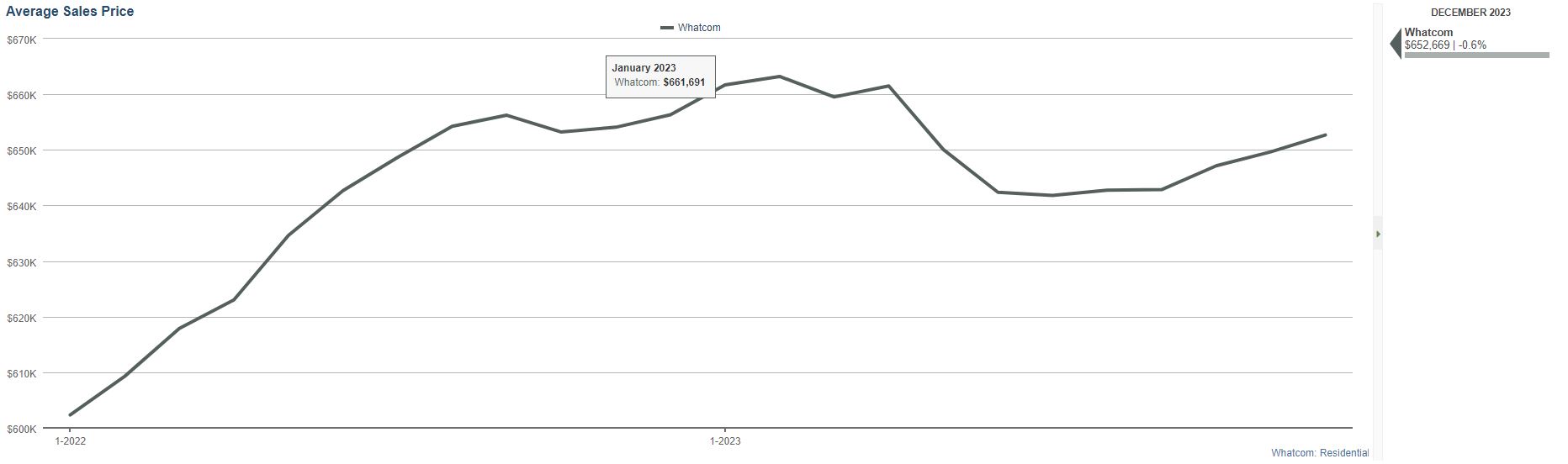

We entered 2023 with interest rates on the rise, and home prices softening. Rates had jumped from 3% to over 6% in a matter of months, and sales were slowing down dramatically.

Interest rates someone leveled off though through the spring, and we saw a surge of sales activity in the spring, with home prices rebounding.

But as the summer kicked in, the rates started rising further. Reaching a peak of around 8% in October. In direct correlation to this, we saw home prices drop in the summer and fall (around 3-5%).

Here is the general trends we can pull from last year moving into the new year:

There is plenty of demand. Bellingham & Whatcom County not only continue to have more people moving here than homes being built, but many home buyers are on the sidelines, ready to jump if rates fall further.

The problem is that many consumers are locked into a 3-4% interest rate on their current home. That has slowed down the normal moving cycle (where people do move-up purchases especially). Home sales in 2023 in Whatcom County were down 22%. Home values were also down, but down only 1% compared to January of 2023. Median prices were down however an average of 3-5%.

What will home prices do next? And how is the first quarter of 2024 going?

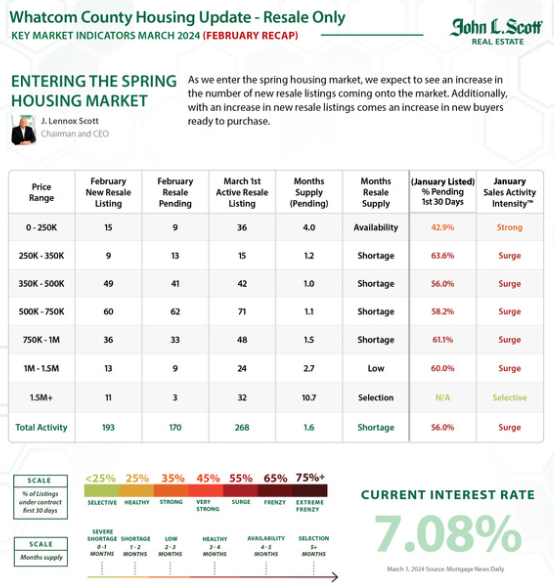

In Bellingham and throughout Whatcom County, the low to mid-price ranges continue to show strength in both demand and home values being stable. While the high end (over $1 million in the county and over $1.5 million in Bellingham) are still showing signs of prices softening. After not seeing much supply at the upper price points, things have changed fairly rapidly in the last 6 months. So in the high end range only, we are projecting home prices will be softer. In every other segment of the market, prices are flat, or actually starting see a bump entering into the early spring.

See the JLS March Housing update below.

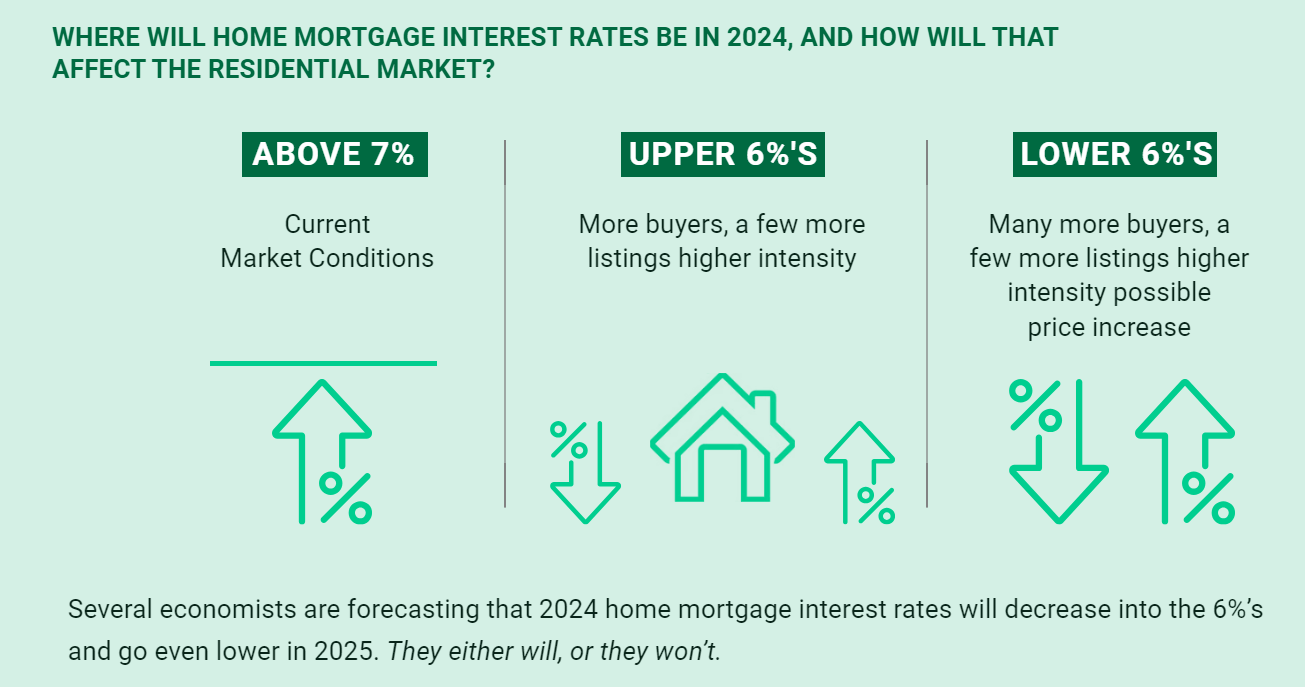

The JLS Housing Forecast from our CEO J. Lennox Scott ultimately is indeed directing predictions based on the interest rates in 2024.

If rates rise again into the 7’s, home values will go down in the mid to upper price ranges, and be slightly down in all price ranges.

If rates stay in the 6’s as they are now, and go down slightly (most are predicting this), sales will increase year over year, and home values should increase slightly in the low to mid price ranges. And be stable up to $1,000,000, and perhaps only slightly drop over $1 million.

If rates drop into the 5’s for most of the year, sales will make a major jump, and home prices will go up in low to mid price ranges, and stabilize on the upper end.

So when is the right time to buy? Remember that if you negotiate a better deal now, the math usually favors the lower price at a higher rate for long-term savings. Particularly since you can always refinance later.

Timing buying or selling we typically then say that the right time to buy is when it is right for you. The long-term forecast in Bellingham & Whatcom County is for appreciation in 2025-2029. We still lack new construction supply & continue to attract retirees & remote workers looking for a mid-sized city where they can enjoy the Pacific Northwest lifestyle.

Here are 2 recent podcasts we recorded on the current market conditions.

For a consultation on when it is right for you to buy or sell, reach out to our associates here.

Download our Buyer’s Guide

Define your goals and expectations, learn local market strategies, finance your home and understand the home purchase process.