The first quarter Real Estate market in Bellingham & Whatcom County was a very hot market, with low inventory, extreme demand, and multiple offer everything. Despite rising interest rates, home prices continued to appreciate at a record rate.

Here is the 1st quarter of 2022 by the numbers:

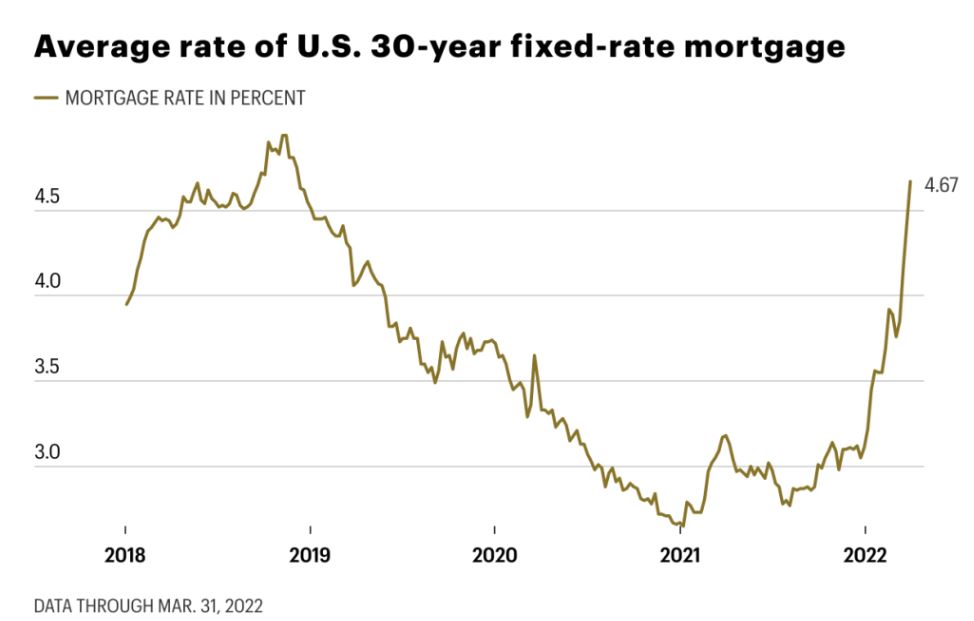

January average interest rate: 3.25%, end of March average interest rate: 4.67%.

Whatcom Home Appreciation: 16%, median home price now: $525,000.

Bellingham Home Appreciation: 14%, median home price now: $601,000

Whatcom Months of Inventory (Absorption Rate): 0.8-month supply. Bellingham supply: 0.5-month.

Home sales in Whatcom County, down 14%. Home sales in Bellingham, down 10%.

Home sales being down (compared to 1st quarter of 2021), is directly related to inventory shrinking. And rising interest is also slowing down sales. This combination– Rising interest rates and a lack of selection, slow down would-be home sellers from listing their home. Indeed, the lack of inventory and higher rates give people less motivation to make a move.

See chart below for Bellingham. 87 homes went under contract in March, compared to 39 active listings. So despite the higher interest rates, the demand for housing is far outpacing supply.

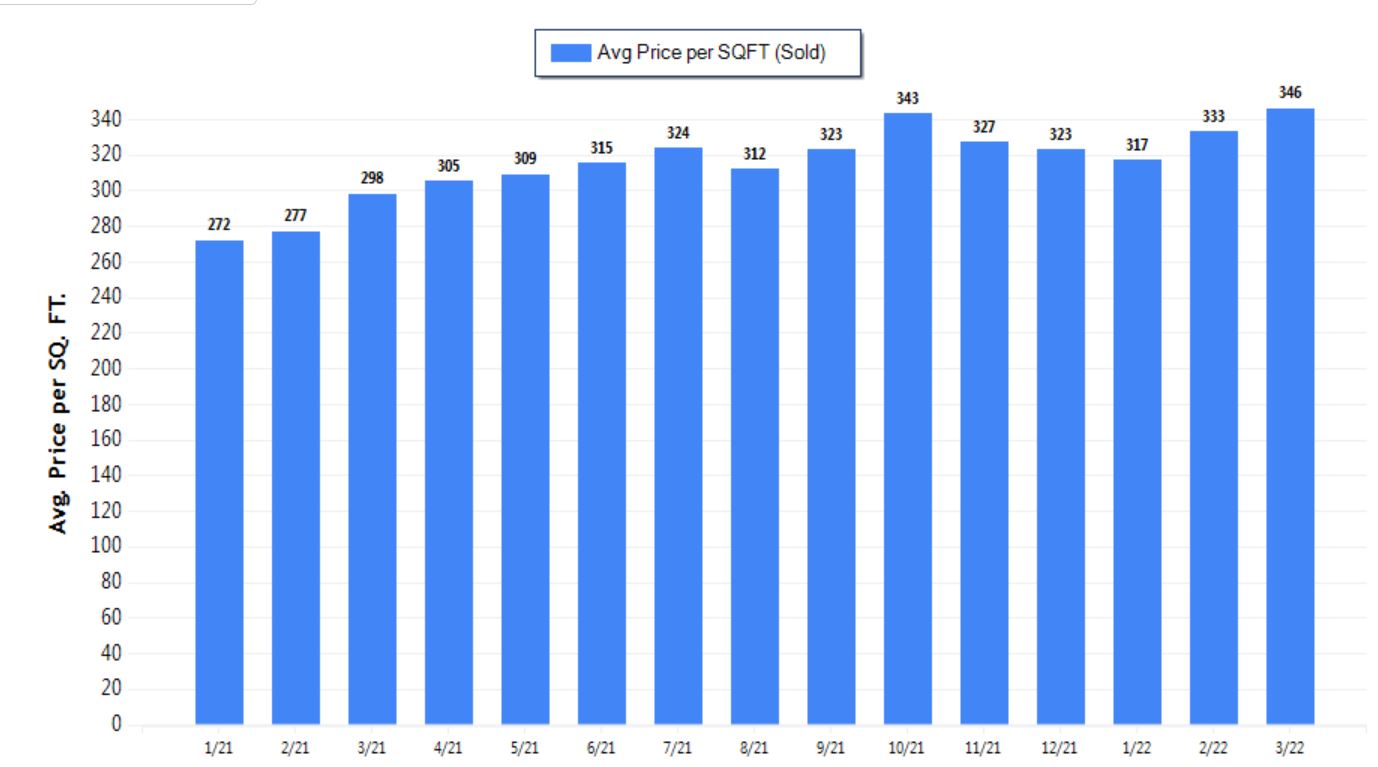

And throughout Whatcom County, homes have been appreciating at a rapid rate. After relatively flat home values November through January, you can see in the chart below -February and March made a big jump, landing at $346 a square foot. This is the highest dollar per square foot on record for Whatcom County.

The process to buy a home has evolved in 2022 as well. In 2021, nearly 50% of homes went under contract with the home inspection waived. In the first quarter of 2022, that jumped up to nearly 75%.

That does not mean buyers are not getting the home inspected. But instead, more activity is occurring during the opening weekend as buyers work to do their due diligence before submitting an offer. Many more buyers are pre-inspecting homes prior to writing an offer. As an example: It’s not uncommon to see a new listing come on Thursday, with 20-30 showings over the weekend, and 3-4 pre-inspections occurring by prospective home buyers.

We are also seeing an increase in the appraisal being waived, or making earnest money non-refundable. Cash sales are also over 20% of pending sales right now.

Essentially offers are bidding well over the asking price in most cases, with fewer clauses and safety nets for buyers—as buyers work all angles to compete. With so many buyers and so few homes, we have never been in a situation quite like this.

Looking ahead, interest rates are slated to continue to tick up further, as the Fed fights inflation. Yet rates from a historic perspective, remain relatively low. In fact, they are just returning right now to about where we saw them pre-pandemic. See the chart below:

Although home sales will increase this spring and summer as inventory increases (as it does every spring and summer), rising rates should slowly start to slow down home appreciation. But more home appreciation appears to still be on the way.

One thing to remember: Even if home sales slowdown (compared to 2021). That is not the same thing as home prices going down. In fact, it is very likely that home sales will slow down, while home prices will still creep up further.

Meaning if you are a buyer waiting for home prices to go down, we don’t project that to occur in the next year. At least for Bellingham & Whatcom County. Nationally, Fannie Mae, Zillow and every major Real Estate economist are also still predicting some home appreciation for the remainder of 2022, and into 2023. So both local and national numbers still show more home appreciation coming. Albeit, at a slower rate.

Need help navigating this very difficult market? We are finding great success helping our clients make it happen. We have services and resources for buyers and sellers that give them a true edge. In fact our company continues to outperform the market and gain market share. With things like “Market Ready Plus” for home sellers, and “Buyer Ready Plus” for buyers, along with partnering lenders offering special bridge loans to help you buy before you sell. Reach out to us for a consultation.

Download our Buyer’s Guide

Define your goals and expectations, learn local market strategies, finance your home and understand the home purchase process.